Explanation

Represents the percentage of total sales revenue that the company retains, after incurring the direct costs associated with producing goods and services.

Formula

(Trading Revenue - Cost of Goods sold) / Trading revenue * 100

Report Codes Used

REV.TRA and EXP.COS

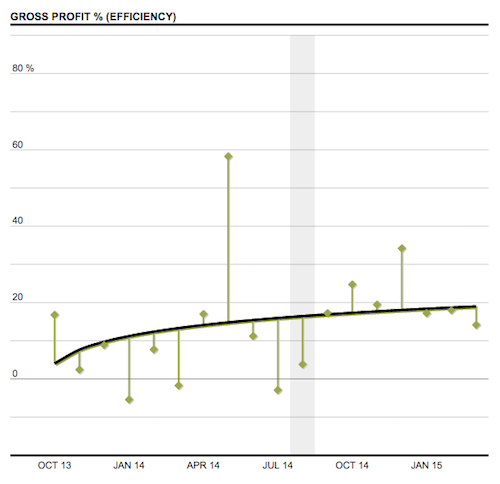

Explanation

Measures the highs and lows of the gross profit percentage over the period against a trend line.

Formula

(Trading Revenue - Cost of Goods sold) / Trading revenue * 100

Report Codes Used

REV.TRA and EXP.COS

Explanation

Shows the net profit at month end compared to the budgeted profit, to track profit progress during the year.

Formula

Series 1: Trading revenue - (Expenses - Income tax expense)

Series 2: Trading revenue [Budget] - (Expenses [Budget] - Income tax expense [Budget])

Report Codes Used

REV.TRA, EXP and EXP.TAX

Explanation

Compares month end net profit this year to the same month end net profit as last year.

Formula

Series 1: Trading revenue - (Expenses - Income tax expense)

Series 2: Trading revenue [Last 12 months] - (Expenses [Last 12 months] - Income tax expense [Last 12 months])

Report Codes Used

REV.TRA, EXP and EXP.TAX

Explanation

Shows the percentage of revenue that is turned into net profit. A higher profit margin indicates a more profitable company that has better control over its costs.

Formula

(Trading revenue - (Expenses - Income tax expense)) / Trading revenue * 100

Report Codes Used

REV.TRA, EXP and EXP.TAX

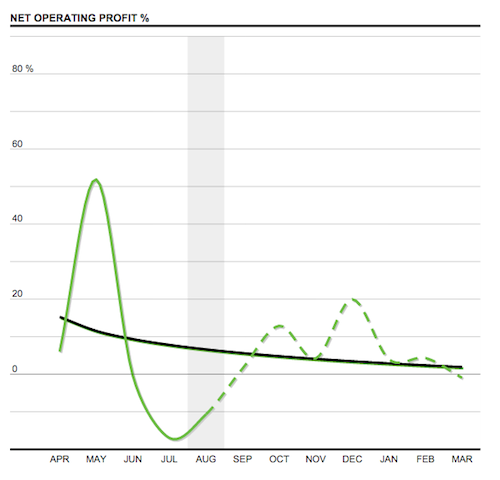

Explanation

Compares the net operating profit percentage this year to the net operating profit percentage last year. Allows you to see if your products or services have become more profitable.

Formula

Series 1: (Trading revenue - (Expenses - Income tax expense)) / Trading revenue * 100

Series 2: (Trading revenue [Previous 12 months] - (Expenses [Previous 12 months] - Income tax expense [Previous 12 months])) / Trading revenue [Previous 12 months] * 100

Report Codes Used

REV.TRA, EXP and EXP.TAX

Explanation

Shows last year's operating profit in a line chart.

Formula

Trading Revenue [Previous 12 months] - (Expenses [Previous 12 months] - Income tax Expense [Previous 12 months])

Report Codes used

REV.TRA, EXP and EXP.TAX

Explanation

Shows the profit made at month end in a line graph.

Formula

Trading Revenue - (Expenses - Income tax Expense)

Report Codes used

REV.TRA, EXP and EXP.TAX

Explanation

Measures the percentage of profit growth over the period.

Formula

((Trading revenue - (Expenses - Income Tax Expense)) / Trading Revenue * 100) - ((Trading revenue - (Expenses - Income tax expense )) / Trading revenue * 100)

Report Codes used

REV.TRA, EXP and EXP.TAX

Explanation

Shows the profit trend over the last 18 months and the projected six months.

Formula

Trading Revenue - (Expenses - Income tax Expense)

Report Codes Used

REV.TRA, EXP and EXP.TAX

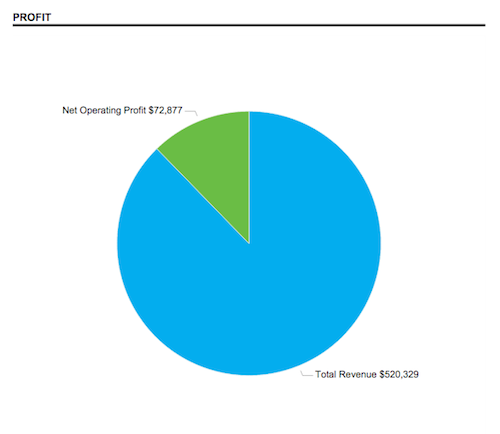

Explanation

Shows a comparison of profit and revenue received, to view how much of revenue is being consumed by expenses.

Formula

Report codes used

REV.TRA, EXP, EXP.TAX

Explanation

Measures the success of achieving Gross Profit and Net Profit against the budget.

Formula

Report codes used

REV.TRA, EXP.COS, EXP, EXP.TAX

Explanation

Comparing Gross Profit and Net Profit against the last year results. Shows how your organisation is tracking against last year's results, to see if the organisation is growing.

Formula

Report codes used

REV.TRA, EXP.COS, EXP, EXP.TAX